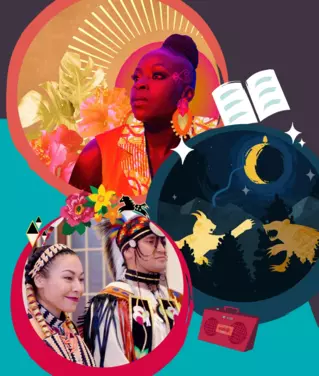

Together

We Move

Join us in a historic moment of movement and change with this special edition t-shirt inspired by AI23 and designed in collaboration with Black-owned Canadian brand Révolutionnaire.

The “Together We Move” t-shirt symbolizes our shared commitment to making ballet more inclusive and reflective of the full diversity of our society. We believe that together, we can make a difference. By wearing this shirt, you join a community of leaders moving together towards systemic evolution in the dance world.

Together

We Move

Join us in a historic moment of movement and change with this special edition t-shirt inspired by AI23 and designed in collaboration with Black-owned Canadian brand Révolutionnaire.

The “Together We Move” t-shirt symbolizes our shared commitment to making ballet more inclusive and reflective of the full diversity of our society. We believe that together, we can make a difference. By wearing this shirt, you join a community of leaders moving together towards systemic evolution in the dance world.